The answer to the “which altcoins to buy?” question depends heavily on pursued objectives. If one wants to make a ton of money, then there are two options:

- trading on exchanges;

- mining.

Why is that? Because thre are no competitors to bitcoin as a long-term investment.

Bitcoin and others

Let’s look at the gold for a moment. It has certain physical characteristics. To change them or improve for specific use, other metals are merged with the gold, alloys are created. To make gold easier to shape, silver is added to it, copper is added for hardness and so on.

Are gold alloys in demand? Obviously, the demand for them arises because of technological needs or because alloys are cheaper.

The bitcoin situation is similar. Everything that fintech has produced since the Bitcoin appearance is an attempt to “improve” it.

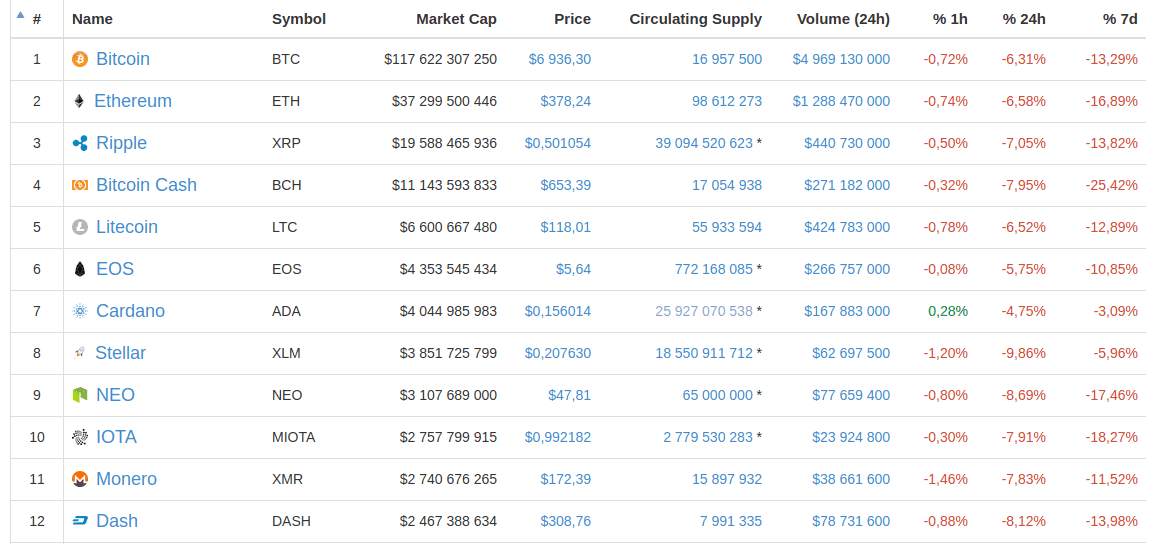

Let’s have a look at the top ten cryptocurrencies according to coinmarketcap.

What did creators of new coins and tokens try to improve in Bitcoin?

The Ethereum developers decided to expand the bitcoin functionality and created a platform for decentralized applications. The system was supplemented by smart-contracts. By the way, Bitcoin also has the ability to create smart-contracts, but here they require more lines of code and are less flexible.

Ripple eliminated the need for miners and rewards for recording blocks. And abolished decentralization.

Bitcoin Cash – arose as a result of dissatisfaction with unsufficient bandwidth in the Bitcoin network. The small block size and high fees prompted part of the community to make a hardfork and go their own way.

Charles Lee created Litecoin, because he did not like the average block time in Bitcoin network. As a result, Litecoin block time is 2,5 minutes intead of 10.

EOS, Cardano, NEO are “improved Ethereum” variants.

Stellar evolved from Ripple to eliminate some of the disadvantages of the latter.

IOTA pushed off Bitcoin and decided to solve problems of mining, network scalability and to basically eliminate transaction fee.

Monero and DASH have focused their efforts on anonymity.

It’s been 9 years since Bitcoin launch. During this time 1600 alternative coins were created. But BTC is still the first in terms of capitalization and trading volume.

Judging by the number of flaws that the creators of other cryptocurrencies tried to correct, and the fact that no project has become a worthy alternative, the safety margin and depth of Bitcoin’s technical solutions are enormous.

Then do I really have to buy altcoins to save the cost? In this respect, any copy is always worse than the original.

But if for some reason you decided to invest in top altcoins of 2018, which altcoins to buy?

In the event that you do not possess insider information, we advise you to earn on the rates of largest cryptocurrencies. Amost the entire top ten of the Coinmarketcap rating can be safely classified as such.

There you can also include currencies that temporarily moved lower in the rating, but for a long time were somewhere near Top-10. These are Monero, DASH, NEM, ZCASH, Waves.

They consistently show high liquidity and capitalization. This means that they are in demand and, working with them, you will not find yourself with a lot of trash that no one needs.

Cryptocurrencies of the Top-10

Ethereum is developing at a huge pace judging by the number of projects created on this platform. This situation even spurred Vitalik Buterin on the April Fool’s joke about the need to take rent for the use of Ethereum blockchain. At the moment ether, like all altcoines, is on the decline, but this is a temporary phenomenon. Projects will begin bring real profits and ether price will go up.

Ripple is also falling, but this is due to a correction from the December take-off of bitcoin. If we take the average line of behavior of this cryptocurrency price in dollars, then it is fairly stable and close to a straight line. The idea, embedded in this altcoin, is in demand by financial structures. More and more banks join the system. So the prospects for the currency are quite good and it can bring a hefty income.

You also have an opportunity “to play” with Bitcoin Cash. It has high volatility and experienced traders make a ton money on this. Large trading volumes allow you to be confident in the liquidity of this asset.

Litecoin is akin to Bitcoin Cash in terms of volatility, so the recommendations in this case are similar.

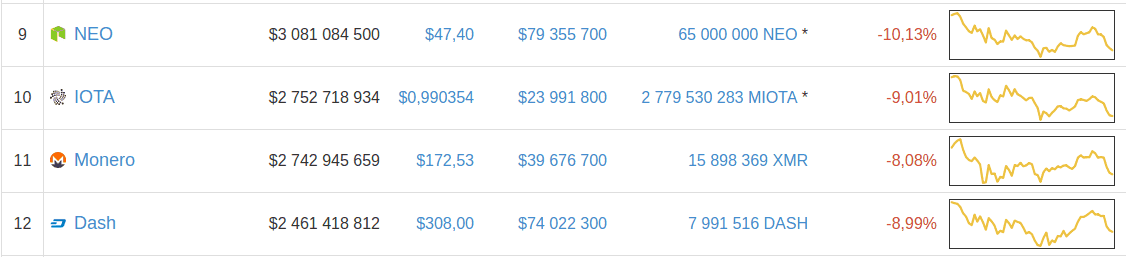

The movement of the EOS course resembles what happens to Ripple, but the idea does not attract the financial bosses, so the currency will be less profitable. The daily trading volume is almost 4 times less than that of Ripple and the percentage drop is lower.

New cryptocurrencies

New cryptocurrencies are advantageous because during the ICO they are sold at a discount. At the very start of exchange listing, their price is low. It can be heated up quite quickly and can fall as quickly. Here you need a high decision-making speed to get a good income. This is mainly speculative profit.

To invest in new projects, you must carefully approach their selection. It will take time to study the documentation, the team, the history of the project participants. You need to communicate with thematic forum participants, assess the vitality of the startup and demand for it.

Observations

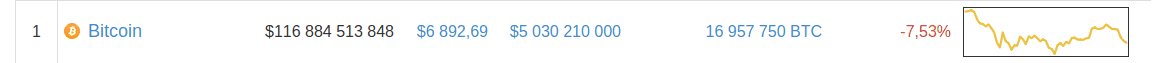

The charts of cryptocurrencies confirm that bitcoin rules all fintech. The price of most altcoins repeats the movement of bitcoin prices. This may occur immediately or with some delay, but the charts look like copied.

Here is the bitcoin chart – in the rectangle on the right.

Let’s look, what the first ten altcoins show.

All screenshots are made at the same time.

Here are the altcoins on 30th to 40-th positions in the rating.

And further down the list things are quite similar.

Mining

Cryptocurrency mining is a very specific occupation requiring knowledge and investments. Much in this process depends on the competition and the reward amount.

If you ignore the costs, the greatest reward for a block is paid in Bitcoin. This is what attracts many to BTC mining.

But the time of solo bitcoin extraction has passed long ago, and pools are often fraudulent. In addition, a large competition and the cost of equipment put a high entry threshold.

That’s why a large number of miners are looking towards mining of altcoins. The reward is less, but the equipment is simpler and cheaper, the number of miners is not so great as in bitcoin network.

Conclusion

If you are not a fan of any technology related to a particular cryptocurrency, then for longterm investment Bitcoin is the best option. This is a reliable and very robust system. All other cryptocurrencies are secondary to it.

You can invest in cryptocurrencies from the top ten to make money on their rate growth or mining. They have already proven themselves both as ideas and as technologies.

All other cryptocurrencies are “something gray” in terms of profits. Some of them break into the tops by trading volume, and then quickly shade away. And many of them are somewhere in the middle of the rating, with nothing special to offer.

Reviews

Your comment has been sent successfully.

More from Cryptocurrency

- Bitcoin faucet list of high paying websites

- Bitcoin faucet bot

- Bitcoin Cash faucet – how to earn online

- Bitcoin ATM in Toronto

- Crypto airdrops – cryptocurrency you can receive for social activity

- Most promising cryptocurrencies 2018

- Top altcoins 2018

- Alternative to Bitcoin: coins that can displace the world’s first cryptocurrency

- How to buy altcoins

- Best Bitcoin mining software